UNEARTHING INCOME OPPORTUNITIES

This article provides a detailed guide to analysing options chains for income opportunities. It covers basic concepts, discusses analysis under different market scenarios, highlights proven strategies with real-life case studies, and concludes with an inspiring trader anecdote emphasizing the significance of delta values.

Remember the early days of trading? Endless hours pouring over data, feeling like you were exploring an intricate labyrinth with no map in sight. Rings a bell, right? Well, I was there too.

Over time, things started making sense. The once confusing labyrinth began to transform, patterns emerged, and voila – a treasure map full of opportunities appeared! What if I told you that you could see this map too?

In this post, we're going to dive into one such 'treasure map' – the options chain. We'll unlock the secrets hidden within, guiding you straight to the potential income opportunities that are just waiting to be discovered. Excited? Let's get started!

Understanding Options Chain

Have you ever felt like you’re making trading decisions in the dark? Guessing and hoping for the best? We’ve all been there. But what if I told you there’s a better way?

Enter the options chain – your very own financial ‘X-ray’. Sounds cool, right?

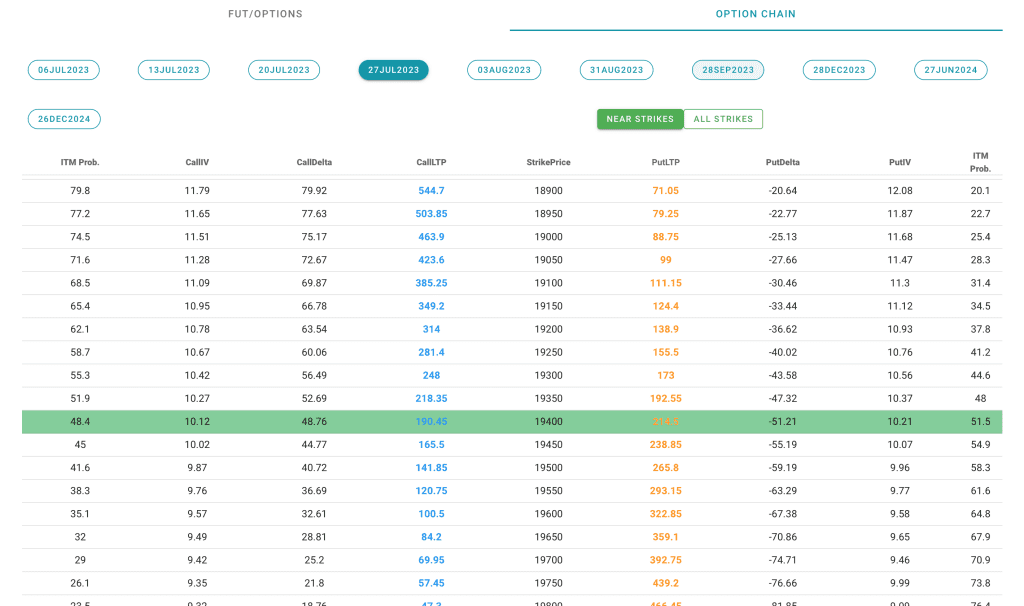

But what does it do? It lays out all the data about the different options contracts available for a security. Think of it as a buffet of data that you can feast on before making your trading decisions.

It’s all neatly arranged in a table. You have your call options and put options, each with its own set of strike prices and expiration dates. Not to mention bid and ask prices. Ever wondered how much other investors are willing to pay and accept for an option? This tool tells you!

Then there’s the volume of options traded and open interest. Heard of these? They show you the number of contracts being traded and the ones left open. Handy info to have, right?

So, do you see it now? An options chain is not just another complex financial term. It’s your guide, your data-rich map to making better, more informed trades. Ready to dive deeper? Let’s go!

Key Components of an Options Chain

Alright, we’re about to dive into the heart of the options chain. Let’s understand it using a hypothetical scenario

Imagine you’re looking at an options chain for our fictional stock, ABC Corp. You’ll notice various ‘Strike Prices’. These are the prices at which you can buy (call) or sell (put) the stock. For ABC Corp, you might see strike prices of ₹500, ₹550, ₹600, and so on.

On the same chain, you’ll spot ‘Call and Put Options’. A call gives you the right to buy ABC Corp at the strike price, while a put lets you sell at that price. The type you choose depends on whether you expect ABC Corp’s price to rise or fall.

You’ll also see ‘Expiration Dates’. These are the deadlines for exercising your options. If you’ve got a Call for ₹500 expiring in May, that’s your deadline to buy ABC Corp at ₹500.

Then there are the ‘Bid and Ask Prices’. This is the range within which traders are buying and selling these options. It’s like a snapshot of what the market thinks.

Look out for ‘Volume’, too – this is the number of contracts traded in a day. High volume for a particular option? That’s a lot of traders getting involved!

Lastly, there’s ‘Open Interest’. It shows how many contracts are open and still need to be settled. It’s like a measure of market interest in a specific option.

As we journey through this data, each component has its story to tell. Understanding these stories? That’s your key to navigating the options chain. Let’s push forward!

How to Analyze an Options Chain

Let’s step into the world of real trading scenarios. Market conditions shape the way we analyze an options chain. Here’s how it works in different situations:

Scenario 1: Bullish Market Outlook

Say you’re feeling bullish. You anticipate a stock’s price will rise. Now, your goal is to spot attractive call options. The right ones have a strike price that aligns with your price target and an expiration date allowing your prediction enough time to materialize.

Scenario 2: Bearish Market Outlook

But what if you’re bearish? You expect the stock’s price to fall. The focus shifts to put options. The ideal contracts have a strike price higher than your price target, and an expiration date providing the market enough time to reflect your forecast.

Scenario 3: High Volatility

In times of high volatility, option premiums often climb. These conditions call for a keen eye on options with high implied volatility – they could offer greater income opportunities.

No matter what the market throws at you, a solid understanding of how to analyze an options chain will keep you on your feet. Ready for the next stage? Let’s see how we can start identifying income opportunities!

Identifying Opportunities with Options Chain

The options chain isn’t just a chart; it’s a goldmine of income opportunities if you know where to look. Let’s delve into some proven strategies for generating income with options trading.

Strategy 1: Writing Covered Calls

So, you’re bullish on a stock and already own it? How about some extra income while you hold? Consider writing covered calls.

You can sell call options on a stock you already own. This way, you pocket the premium right away. If the stock price stays below the strike price at expiration, you keep your stock and the premium.

Strategy 2: Selling Naked Puts

What if you’re bullish on a stock, but don’t own it yet? Selling naked puts could be your strategy.

By selling a put option, you receive the premium and agree to buy the stock at the strike price if it falls that low by expiration. If it doesn’t, you just pocket the premium.

Strategy 3: Straddles in High Volatility

In highly volatile markets, premiums rise. This is where a straddle strategy could come into play.

A straddle involves buying a Call and a Put at the same strike price and expiration date. It’s a bet on high volatility, but not on a particular direction. If the stock moves significantly in either direction, one of your options could bring in a substantial profit.

Understanding these strategies and how to spot opportunities for them on the options chain is a skill that can generate steady income over time. Ready to put these strategies to work? Your next income opportunity might be just around the corner!

Summary

You know, options trading reminds me of a treasure hunt. A treasure map can seem overwhelming at first – just like an options chain. But once you crack the code, the map leads to hidden riches. That’s been my experience.

One of our students compared options trading to surfing. “You have to catch the right wave,” he would say. He spent a long time struggling with his credit spreads until he started paying more attention to the options chain, specifically the delta values.

It was like finding the perfect surf spot. The delta values became his guide, telling him when the waves – or in his case, profits – were most likely to roll in. This small shift in focus transformed his trading strategy, leading to a higher probability of profits on his credit spreads.

Just like that trader, now you’ve got the knowledge to spot those income opportunities in the options chain. Ready to ride the wave to greater profits? Let’s put these insights to work!

Frequently Asked Questions

What is an options chain?

An options chain is a list of all available option contracts, both puts and calls, for a given security. It includes information like strike prices, expiration dates, and premiums, helping traders make informed decisions.

How can analyzing an options chain help me find income opportunities?

By analyzing an options chain, traders can identify attractive call or put options under different market scenarios. They can spot options with high implied volatility or observe the imbalance between put and call volume, both of which can lead to potential income opportunities.

What are some strategies to generate income using options?

Strategies for generating income with options include writing covered calls, selling naked puts, and implementing straddles during high volatility. The choice of strategy depends on the trader’s outlook on the stock and market conditions.

How does delta value impact the probability of profit in options trading?

The delta value provides an estimate of how much an option’s price will change if the underlying stock price changes by ₹1. Traders often use delta to estimate the probability that an option will be in-the-money at expiration, which can aid in identifying income opportunities.

How important is it to understand different market scenarios when analyzing an options chain?

Understanding different market scenarios is crucial. Market conditions like bullish, bearish, or high volatility impact option prices and the strategies that a trader may choose to employ. Knowing how to analyze an options chain under different scenarios can enhance decision-making and trading strategy.