This article explains how professional traders manage their strategies using business tactics. By treating trading like a business, keeping a trade journal as a financial statement, and considering each strategy as a product, traders can apply the BCG Matrix to scale, support, or scrap strategies based on their performance.

Jump to ...

In the world of trading, achieving consistent success means not only understanding the financial markets but also operating your trading activities like a well-oiled business machine. Legendary investor Warren Buffett once said, “I am a better investor because I am a businessman, and a better businessman because I am an investor.” This statement signifies the importance of treating your trading like a business.

This article will delve into how professional traders scale, support, or scrap their trading strategies by utilizing business strategies, such as keeping a trading journal and using the BCG Matrix.

The Trade Journal: Your Business Financial Statement

In a traditional business, keeping track of financial records is paramount to understanding the business’s financial health and making informed decisions. The trading equivalent to this would be a trade journal, an essential tool that allows traders to document their trades and reflect on their performance.

A well-kept trade journal can provide a clear picture of your trading performance, allowing you to identify trends, evaluate strategies, and ultimately improve your trading effectiveness. Just as a CFO analyzes the company’s financial statements to inform decision-making, you should review your trading journal regularly to optimize your trading strategies.

John Murphy, author of “Technical Analysis of the Financial Markets,” emphasized the importance of keeping a trading journal by saying, “A written record of all your activity is like having a mirror to your trading soul.” [1]

Trading Strategies as Products

In the same vein, each of your trading strategies should be treated like a product line in a business. Every product has a lifecycle, with stages of growth, maturity, and decline. Similarly, trading strategies can go through similar stages depending on market conditions and their effectiveness.

An insightful article by trading expert Dr. Van K. Tharp, “Develop a System that Fits You,” discusses the need for a variety of strategies in a trader’s arsenal. Each strategy serves a specific purpose and performs differently under varying market conditions. [2]

The BCG Matrix: A Strategic Tool for Trading

Just as businesses use the Boston Consulting Group (BCG) Matrix to manage their product portfolios, traders can use the same concept to manage their trading strategies.

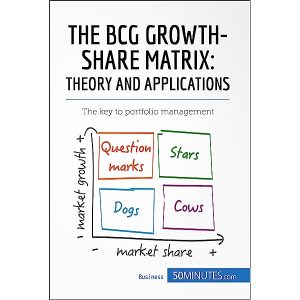

For those unfamiliar, the BCG Matrix is a strategic planning tool that helps businesses evaluate their product portfolios based on their relative market share (representing competitive advantage) and market growth rate (representing market attractiveness).

For those unfamiliar, the BCG Matrix is a strategic planning tool that helps businesses evaluate their product portfolios based on their relative market share (representing competitive advantage) and market growth rate (representing market attractiveness).

The matrix consists of four quadrants:

- Stars: High growth products with a high market share.

- Cash Cows: Low growth products with a high market share.

- Question Marks: High growth products with a low market share.

- Dogs: Low growth products with a low market share.

In a trading context, your strategies can fit into these categories:

- Stars: High performing strategies during favorable market conditions.

- Cash Cows: Consistently profitable strategies that work in most market conditions.

- Question Marks: Strategies that sometimes yield great results, but their reliability is questionable.

- Dogs: Strategies that rarely, if ever, produce profitable results.

By plotting your strategies on the BCG Matrix, you can better understand the current performance and potential of each strategy. You can then decide to scale (for Stars), support (for Question Marks), or scrap (for Dogs) each trading strategy.

Professional trader and author Mark Douglas highlighted the importance of adapting to market changes in his book “Trading in the Zone”: “The consistent winners are those who are adaptable to the markets. Always be flexible and open-minded.” [3]

Understanding these business principles and tools and applying them to your trading can significantly improve your trading efficiency and profitability. So remember, think of your trading as a business. It’s the path to becoming a professional trader.