Jump to ...

Discover how to generate passive income with cash-secured puts, a powerful options trading strategy. Explore real trade examples and learn how to earn consistent profits while minimizing risk. Unleash the potential of cash-secured puts and embark on your journey towards financial independence.

Are you searching for a reliable method to generate passive income? Look no further! In this article, I will share my journey of generating passive income through cash-secured puts. This powerful options trading strategy has allowed me to earn consistent profits while minimizing risk. Join me as we dive into the world of cash-secured puts and uncover the potential it holds.

Understanding Cash-Secured Puts

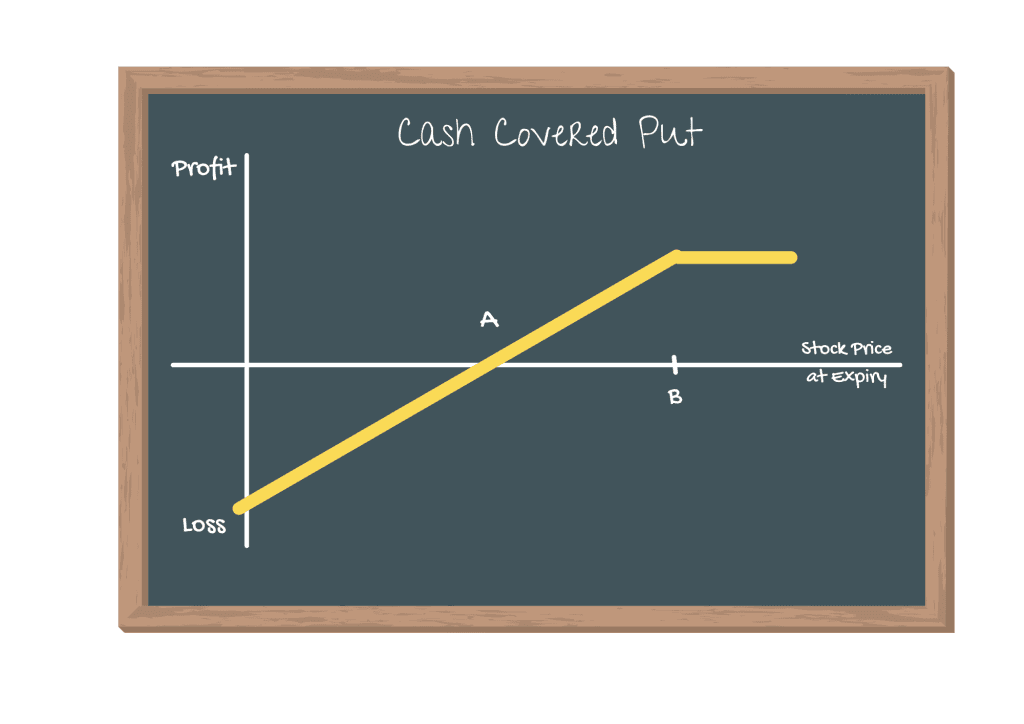

Cash-secured puts are a trading strategy that involves selling put options while holding the necessary cash to cover the potential obligation. When you sell a put option, you essentially agree to buy a stock at a predetermined price (strike price) within a specified time frame (expiration date). By doing so, you collect a premium upfront.

Trade Example 1: XYZ Stock

Let’s explore a trade example to understand this better.

Suppose XYZ stock is currently trading at ₹50 per share, and you believe it is a great investment opportunity. You can sell a put option with a strike price of ₹45 and an expiration date of one month. For this, you receive a premium of ₹2 per share.

Now, there are two possible outcomes:

1. XYZ stock remains above the strike price (₹45): In this scenario, the put option expires worthless, and you keep the premium collected as profit. You can then repeat the process and generate more income.

2. XYZ stock drops below the strike price: If the stock price falls below ₹45, you may be obligated to buy the shares at the strike price. However, since you held the cash to cover this obligation, you can effectively acquire the shares at a discount and potentially sell them later for a profit.

Benefits of Cash-Secured Puts

Cash-secured puts offer several compelling benefits:

Consistent Income Generation:

By strategically selecting stocks and options, you can generate regular income through the premium collection. Now, even though this doesn’t sound like too much, when done right this can actually amount to quite a lot over the months. You can treat this as passive income, or as discount on the price of the underlying shares that you are interested in holding for the long term.

Lower Risk:

Compared to simply buying stocks outright, cash-secured puts provide a cushion of protection. You enter into trades with a predetermined risk profile and only commit to purchasing the stock if it meets your desired criteria.

Potential Stock Acquisition:

In case the stock price drops below the strike price, you have the opportunity to acquire the shares at a discounted price, allowing for potential future gains.

Trade Example 2: ABC Stock

Let’s explore another trade example to showcase the potential for stock acquisition. Assume ABC stock is trading at ₹60 per share, and you sell a put option with a strike price of ₹55 and an expiration date of two months, receiving a premium of ₹3 per share.

If ABC stock falls below the strike price, you may be assigned the shares. However, you can then capitalize on the opportunity to own ABC stock at a discounted price, potentially benefiting from any future price appreciation.

FAQ Section

Is trading in Options risky?

Options trading, including cash-secured puts, involves risks. It’s essential to understand the potential risks and rewards of trading options. Conduct thorough research and consult with a qualified financial advisor before engaging in any trading activity.

How do I select the right stocks for cash-secured puts?

It’s crucial to evaluate stocks based on their fundamentals, market trends, and your investment goals. Look for stocks with strong underlying value and consider their volatility and liquidity. Conducting thorough analysis and staying informed will help you make informed decisions.

How much capital do I need to get started?

The amount of capital needed depends on the specific trade and the strike price you choose. It’s advisable to start with a capital amount that you’re comfortable risking. Begin with smaller positions as you gain experience and confidence.

What is the best way to manage risk in cash-secured puts?

Risk management is crucial in options trading. Set clear risk tolerance levels, diversify your trades, and implement stop-loss orders to protect against significant losses. Regularly assess and adjust your portfolio to maintain a balanced risk profile.

Conclusion

Generating passive income through cash-secured puts is a powerful strategy that allows you to earn consistent profits while managing risk effectively. By leveraging options trading, you can collect premiums, potentially acquire stocks at discounted prices, and generate a reliable income stream.

Remember, thorough research, careful selection of stocks, and disciplined risk management are vital for success. Start small, gain experience, and continuously refine your approach. Harness the power of cash-secured puts and embark on your journey towards financial independence.

Disclaimer:

Options trading involves risks, and it’s important to consult with a qualified financial advisor before engaging in any trading activity.