DESCRIPTION

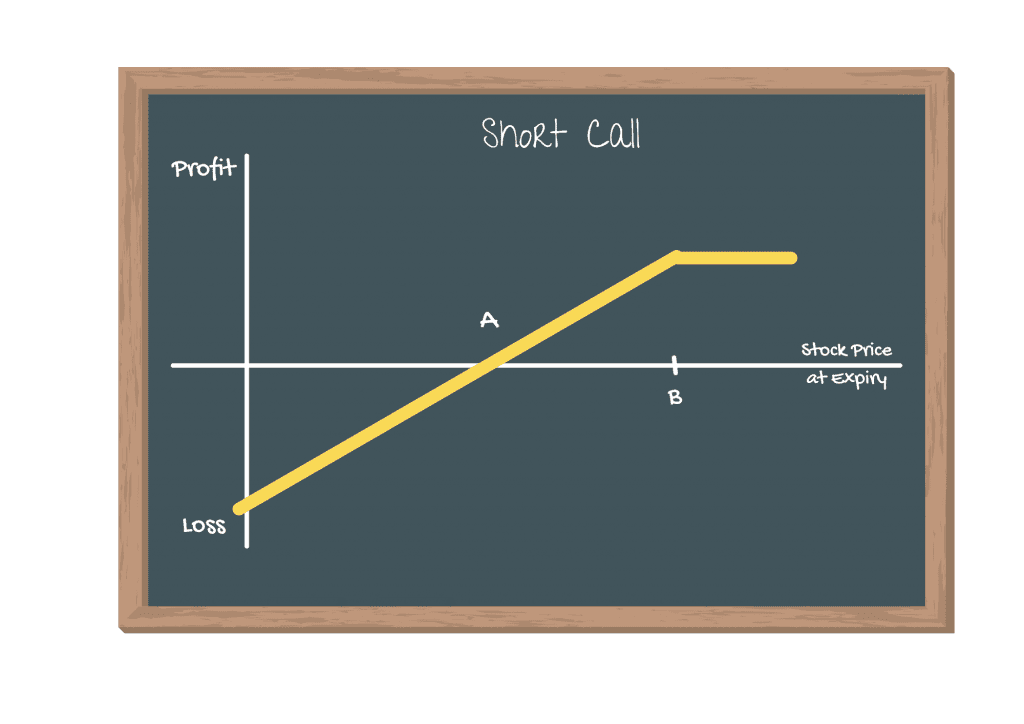

The Short Call is considered as one of the basic strategies since it is easy to execute. However, shorting a call (without a cover) is a risky strategy so, like most experts, I always categorize it as an advanced strategy. Shorting a call exposes us to unlimited risk if the underlying stock rises quickly.

A call is an option to buy and therefore if we are shorting it (selling to open), we are expecting the market to go down.

ITM | In-the-money | Stock price < call strike price |

ATM | At-the money | Stock price = call strike price |

OTM | Out-of-the-money | Stock price > call strike price |

STEPS TO TRADING A SHORT CALL

- Sell the call option

Remember:

- Each contract gives you the option to buy the number of the underlying asset as per the lot size. For example, for the HDFC BANK, buying 1 lot gives you the option to buy 550 shares of HDFC BANK.

- Options for the indices like NIFTY or BANKNIFTY are cash-settled. That is, if your call option closes ITM, you will be credited the amount of the profit and vice versa for OTM options.

RATIONALE

- While shorting a call your outlook is bearish, you are expecting the price to fall.

- The rationale is to pick up short-term premium income as the stock develops price weakness

NET POSITION

- This is a net credit transaction since you are receiving a premium for the call

ADVANTAGES

- If done correctly, you can profit from falling or range-bound stocks with the short call

DISADVANTAGES

- Uncapped risk potential if the stock rises

- A risky strategy and according to us should never be recommended

EXITING THE POSITION

- Buyback the option you sold (buy to close) or wait for the sold option to expire worthless (if ITM) so that you can keep the premium you received

MITIGATING A LOSS

- Use the underlying asset or stock to set up your stop loss

Cost | Net credit trade. You receive the premium |

Maximum Risk | Uncapped |

Maximum Reward | Limited to the premium received for selling the call |

Break-even | Strike price + Call Premium received |

Margin Required | As per Margin requirement of broker and Stock Exchange |

Effects of Time decay | Time decay is your friend. You want the price of the call you sold to approach zero. |

Effects of Volatility | After you are in the trade, you want the volatility to decrease. This will decrease the price of the call you sold. |

EXPERT TIP

- If you must use this strategy (we don’t suggest it), work with OTM options. Select a strike at least one standard deviation away from the current price. This will put the probability of success in your favor.

- Working with Index options is a better idea since the volatility of individual stocks tends to cancel each other out. Thereby giving the index a more stable outlook.