Mastering the Calendar Spread Strategy in Options Trading

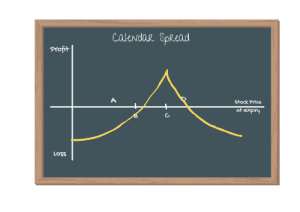

The article explores the calendar spread strategy in options trading. This advanced technique involves buying and selling options with different expiration dates but the same underlying asset and strike price. By leveraging time decay, traders can benefit from limited risk, income generation, and the ability to profit from neutral market conditions.

Options trading offers a wide range of strategies to capitalize on market movements and generate profits.

One such strategy gaining popularity among traders is the calendar spread. This advanced options trading technique involves simultaneously buying and selling options with different expiration dates but the same underlying asset and strike price.

By leveraging time decay and volatility, the calendar spread strategy presents traders with unique opportunities for consistent returns. In this article, we will delve into the mechanics, benefits, and risks associated with calendar spreads.

Understanding the Calendar Spread:

The calendar spread, also known as a horizontal spread or time spread, is a neutral strategy that relies on the concept of time decay.

It involves simultaneously entering into a long position on a longer-dated option while taking a short position on a shorter-dated option, both with the same strike price. Typically, the trader purchases the later-dated option and sells the near-term option.

This strategy is commonly used when the trader expects the underlying asset to remain relatively stable over the short term.

Mechanics of a Calendar Spread:

To implement a calendar spread, the trader should select options with the same strike price but different expiration dates.

To implement a calendar spread, the trader should select options with the same strike price but different expiration dates.

The long position on the later-dated option provides a hedge against significant price movements, while the short position on the near-term option generates income to offset the cost of the longer-dated option.

The goal is to benefit from the time decay of the near-term option, which erodes its value at a faster rate than the later-dated option.

As time progresses and the expiration date of the near-term option approaches, its value decreases, allowing the trader to profit from the spread’s widening.

Advantages of Calendar Spreads:

One of the key advantages of the calendar spread strategy is the limited risk involved. Unlike other strategies that rely on price direction, calendar spreads are designed to profit from time decay.

Additionally, calendar spreads can be tailored to specific market conditions, making them versatile in various market scenarios. They allow traders to generate income through the sale of options while still maintaining a degree of protection through the purchase of longer-dated options.

Moreover, the strategy can be profitable even if the underlying asset’s price remains relatively unchanged.

Considerations and Risks:

While the calendar spread offers compelling benefits, it is crucial to be aware of its inherent risks.

Time decay may work against the trader if the underlying asset experiences substantial price movements. If the price moves too far from the strike price, the profit potential of the calendar spread can be significantly reduced.

Furthermore, changes in implied volatility can impact the spread’s profitability. A rise in volatility may increase the value of both the long and short options, reducing potential gains.

Traders must carefully assess market conditions and select appropriate strike prices and expiration dates to mitigate these risks.

The calendar spread strategy is a powerful tool in options trading, allowing traders to capitalize on time decay and neutral market conditions.

By employing this strategy, traders can benefit from income generation while managing risk.

However, it is vital to understand the dynamics of the market, select appropriate options, and monitor positions actively. With proper analysis and risk management, the calendar spread strategy can be a valuable addition to any options trader’s toolkit.