The best way to gauge a strategy is to see it work over and over again.

Anshul Pathania

If you have ever tried to understand how professional traders or all the big trading firms develop new trading strategies, this article is going to be of special interest to you.

Imagine you’ve come across a trading signal. Somebody has told you about a new trading signal or technical indicator that’s supposed to be a real money maker.

How do you react to it?

What do you do?

Do you reject it outright?

Or do you accept it whole-heartily and put good money behind it?

Or do you, like professional traders, follow a series of steps that take you from not knowing anything about the strategy to actually putting it into production?

Professional traders and trading firms are dead serious about the trading business. How they react to new strategies and how they subsequently develop these strategies is what we need to follow as well.

In this article, I’m going to talk about the ongoing process that we have put in place for developing new strategies.

STRATEGY DEEP DIVE

We start from awareness of the strategy where we understand the strategy in a little more detail.

The idea is to get a good understanding of what we can expect from this strategy in terms of performance, risk, and reward.

The questions you should be asking are:

- What is the background of the developer?

- Who is using it?

- What kind of results are claimed?

- What kind of results are expected?

- Does it tie in with my experience and overall trading philosophy?

Once we understand that this strategy is worth looking at we start working on data-driven analysis.

We start with backtesting, then move on to forward testing or virtual trading.

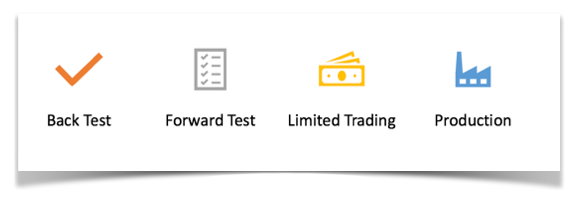

BACKTEST

At this stage, we are looking to the past. If we had executed the strategy and followed the rules to the T (let’s face it, without the right mindset, this is very hard to do), how much money would we have made?

For this, we follow a two-step model.

First, we work manually on a limited amount of data. Depending on the type of strategy, this could range from a few weeks (intra-day strategy) to a year (swing, or positional trading).

The reason we work on this manually is that we want to get a good handle on the strategy – understanding the nuances and working on the details. The general idea is that before we automate the process, we should have a fair understanding of what it entails.

We execute the trade as per the trading system and record the date, time, scrip, entry price, and exit price.

We look at the results of the manual backtest and then go forward with the automated test.

As the name suggests, this stage requires the use of software to do the heavy lifting for us. There are many software options available for this.

Watch the video to look over my shoulder and see how it is done.

FORWARD TEST

Once we are satisfied with the results thrown up by the backtest, we start deploying the strategy, after any refinements, in the live market.

But we are still not ready to put actual money in it.

At this stage, we take the trade as if we are actually taking the trade but do so only on paper. Recording the details of the trade – date, time, scrip, entry price, and exit price.

This is also known as Virtual Trading or Paper Trading.

The number of trades we take in this stage will depend again on the type of strategy, but also on the level of comfort we have. The more the better, but I suggest at least 10 trades.

At each of these stages, we analyze the results and understand whether it makes sense to move forward or abandon the strategy altogether.

FINE-TUNING

If the results are good, we move forward. If the tests are not very good, but it is possible that with a bit of fine-tuning we will be able to better the results then we make the adjustments and run the tests again.

After we have some data on the performance of the strategy in the test environment, we crunch those numbers to see what the performance metrics are – success ratio and risk-to-reward ratio are the all important parameters.

By this time, we will have a fair idea of what our risk management plan will be. The risk management plan is then constructed.

And then, finally, we are ready to put our toes in the water.

LIMITED TRADING

Using the fine-tuned version of the strategy, together with the risk management plan, we enter the limited trading stage.

In this stage, all the parts of the trading system are put together and tested in the live market with real money. We are still not 100% sure of the strategy, so we use a token amount of capital.

This stage can take anywhere between a few weeks to a few months, depending on the strategy and test results.

Again, the trade details are recorded – date, time, scrip, entry price, and exit price. And then the performance metrics are analyzed.

PRODUCTION

After going through the above stages, (and assuming the strategy makes it through these stages), we are finally ready to put our strategy into production.

The final version of the trade plan is completed, the money transferred to the trading account, and the execution put in place.

However, at no point is it assumed that the strategy will work exactly how we planned. This is why we monitor the strategy periodically.

Watch the video in which I take you through the live testing of a strategy.

Now that you know how to the professionals test new trading systems, you too can make sure that your strategies are worth deploying BEFORE you put real money behind them.

You can also attend one of our free webinars, and understand the various components of a trading system. In this webinar, I take you through the various components and help you understand how to get consistently profitable from trading.

One Response